For some businesses, issuing a VAT invoice to your customers is necessary in order to ensure compliance with tax regulations and maintain a seamless transaction experience for customers. So if you’re a business owner operating in the UK, it’s crucial that you understand VAT invoicing and your obligations to HMRC.

In today’s guide, we’ll outline the steps necessary to issue a VAT invoice, explain the information that must be included on a VAT invoice and provide insights into electronic invoicing and record-keeping.

Does Your Business Need to Register for VAT?

Before issuing a VAT invoice, you must first determine whether your business needs to register for VAT. This typically depends on the threshold for annual taxable turnover set by HMRC, but can also depend on the nature of your business or the location of your operations.

Please check out our article How to Register for VAT in the UK, which describes how, and more importantly when, you need to be VAT registered. In general, businesses with a taxable turnover exceeding the established threshold must register for VAT. You may also wish to refer to HMRC’s guidelines for specific registration requirements.

Registering for VAT

While you can register for VAT yourself, unless you know what you’re doing, it is highly advisable that you first consult an accountant. Your accountant can steer you through VAT scheme selection and also perform the task of VAT registration on your behalf. Like most things these days, it can all be performed online. But before you rush off to the HMRC website to get registered, you’ll need to learn about different VAT schemes available.

During the consultation with your accountant, ask about the different VAT schemes that you can avail of. Depending on your business, you may avail of one scheme or another, or a combination of more than one VAT scheme. Your accountant can help you choose the right VAT scheme(s) that suit your business, then get your business signed up to that scheme.

As part of the VAT registration process, you will be required to provide the details of your business and you may also be required to submit documents such as a business licence, proof of address, and bank account information. Upon successful registration, you will receive a VAT identification number, which should be reproduced on all VAT invoices that your company issues.

We have articles covering different UK VAT schemes that you can avail of, including:

What’s In a VAT Invoice?

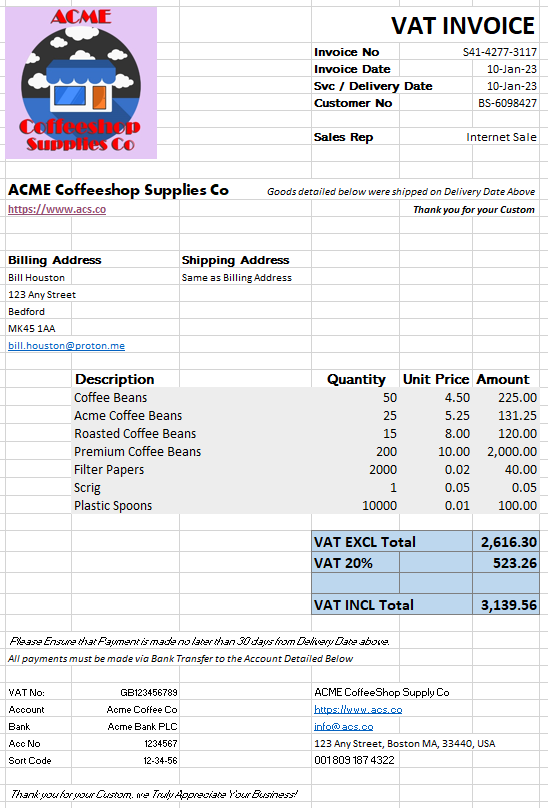

Below you can see a typical full VAT invoice.

When preparing a VAT invoice, you must include specific information to ensure compliance with tax regulations. A VAT invoice should generally include:

- A unique invoice number

- The invoice date and, if different, the tax point (the date when the VAT becomes due)

- Your business name, address, and VAT identification number

- Your customer’s name and address (and VAT identification number if they are VAT-registered)

- A clear description of the goods or services provided

- The quantity and unit price of each item

- The rate of VAT applied to each item

- The total amount of VAT charged

- The total amount payable, excluding and including VAT

Included below is a link to this file if you want to reuse it.

Understand the Different Types of VAT Invoices

There are generally three types of VAT invoices: full VAT invoices, simplified VAT invoices, and modified VAT invoices. Each type of invoice has different requirements for the information that must be included:

Simplified VAT Invoice

Simplified invoices require less information and are quicker to issue. They’re often used in retail settings, since these transactions are below a specific monetary threshold.

Full VAT Invoice

A full VAT invoice includes comprehensive details about the transaction, the goods or services provided, along with the VAT charged. A full VAT invoice is typically required for transactions above a certain monetary threshold.

Modified VAT Invoice

This type of invoice is employed for any business that might sell products or services with different VAT rates or have mixed supplies, combining both taxable and exempt items. There are several types of exempt items, ranging from children’s clothes and shoes through to prescription medication. There are also a range of reduced-rate items including domestic fuel and power, mobility aids for the elderly, children’s car seats, and so forth.

For further information on VAT rates, zero-rated items, and reduced-rate items, check out our article What is the Current Rate of VAT?.

Issue VAT Invoices Promptly

To ensure timely payments from your customers, it is good practice to issue VAT invoices promptly. You should ensure that doing so is a matter of business process or standard operating procedure for you and your staff. Doing so should be a natural part of the maintenance of accurate records. Typically, a VAT invoice should be issued within a specified timeframe, such as 15 or 30 days from the tax point.

In a retail setting, a VAT invoice may be produced and presented to the customer at the point of sale, or if your customer has a repeat order or prescription, you may issue these VAT invoices electronically.

Once you have prepared the VAT invoice and provided a copy to your customer either electronically or in hard copy, it is essential to keep a record of all issued VAT invoices for your business’s financial records and future tax audits.

Automate Invoicing

Automating the process of issuing invoices is an important step for businesses. Issuance and receipt of invoices through automated processes (computers) streamlines the sale process, freeing up the time of your staff and reducing the reliance on paper documents. Adopting this approach to invoicing saves time and resources, eliminates error, and so improves the overall efficiency of your business operations.

Choosing E-Invoicing Software or a Service Provider

There exist numerous e-invoicing platforms and service providers on the market. You should review those that fit your criteria, then select the one which best meets your business needs, offers robust security features, and complies with HMRC regulations. Look out for our upcoming comparison review of e-invoicing software.

Integrate E-Invoicing with Your Existing Systems

Ensure that the e-invoicing platform you choose can seamlessly integrate with your existing systems and processes. There’s no point investing in e-invoicing software that is a single-user only solution if you’ve got multiple staff, for example.

Train Your Team

Training your staff on the use of the e-invoicing platform and the importance of accurate invoicing is essential. Your staff are your best asset and regular training sessions can help ensure that your team stays up-to-date with the central importance of issuing proper VAT invoices and maintaining accurate records.

Maintaining Accurate Records to Comply with Tax Regulations

Proper record-keeping is essential for any business issuing VAT invoices. In addition to maintaining copies of all issued VAT invoices, you should also keep records of:

- VAT registration documents

- Sales and purchase records

- VAT returns and supporting documentation

- Any adjustments or corrections made to previous VAT returns

TOP TIP: These records must typically be kept for a specified period, which in the UK is six years.

Submit VAT Returns and Make Payments

As a VAT-registered business, you are responsible for submitting periodic VAT returns and making VAT payments to HMRC. The frequency and deadlines for VAT returns and payments vary by VAT scheme, so be sure to discuss these specifics with your accountant.

Conclusion

Invoicing is a fundamental task for all businesses in the UK. Having identified your business as needing to become VAT registered, your next step is to engage with your accountant to become registered. Once registered, you’ll receive a VAT number for your business and you must ensure that your business issues VAT invoices that include this VAT number.

Understanding the different types of VAT invoice and including the required information is essential to ensure compliance with HMRC regulations.

Once you’ve nailed VAT invoicing, automating the invoicing process helps streamline your business, making compliance with tax regulations a part of your standard operating procedure.

Finally, keeping accurate records, making regular VAT payments, and submitting VAT returns at the required time will ensure that your business is fully compliant with HMRC regulation.